How to Start an LLC in Georgia

Georgia can be a good state for starting an LLC.

From its relatively low formation fees and generally pleasant weather to its talent pipeline fed from well-regarded public universities, the Peach State has a lot to offer.

And starting a limited liability company (LLC) in Georgia can be an excellent choice for those looking to establish a business structure that can limit their personal risk.

In this guide, we’ll examine the seven main steps you’ll need to take in order to register an LLC in Georgia.

Are you ready? Let’s get started.

7-Steps to Start an LLC in Georgia

- Step 1: Pick a business name for your LLC

- Step 2: Designate a registered agent

- Step 3: File the Georgia LLC Articles of Organization

- Step 4: Obtain an EIN (Employer Identification Number) from the IRS

- Step 5: Register with the Georgia Department of Revenue and Department of Labor

- Step 6: Prepare an LLC operating agreement

- Step 7: Open a Georgia business bank account

Step 1: Start by confirming a business name for your LLC

Choosing a name for your LLC is the first company formation step. In Georgia, as in many other states, your LLC’s business name needs to be distinguishable from other registered corporations, LLCs, and limited partnerships in the state.

To see if a business name is available in Georgia, you can use the online search tool on the Secretary of State (SOS) website. However, this database does not officially determine if a name is available. Instead, you can lock in your name when you register with the state.

Name reservations

If you have a good idea for a name but aren’t quite ready to submit the rest of your LLC paperwork, you can submit a name reservation request to the Georgia SOS for $25.

When doing so, you can submit up to three name choices in case some are taken already. If approved, your name reservation is valid for 30 days, so you’ll want to file the rest of your LLC paperwork by then.

If you’re still not ready, you can renew the reservation for extra 30 days and pay an additional $25 fee.

Trade name

Some businesses may use a trade name as an alternative to their legal LLC name. Georgia law generally requires companies that use a trade name, which is sometimes called a DBA or fictitious name, to register with the Clerk of Superior Court offices where they’re located.

Trade name registration costs differ slightly among different counties in Georgia. But to give you an example, the rate is $171 in Fulton County, where Atlanta is located.

Also, remember that registering a trade name typically doesn’t provide the same protection as LLC incorporation. Thus, you may also want to take legal steps like trademarking your trade name, for example.

Step 2: Designate a registered agent

After picking out a name for your LLC, you’ll need to designate a registered agent. A registered agent is simply a person or company with a street address in Georgia that receives your official mail and other types of communication.

Georgia limited liability companies need a registered agent located within the state who’s available at the designated address during regular business hours, whether a home address or an office. You can’t use a P.O. box.

You or another member of your LLC can be the registered agent. But many businesses choose to use a third party such as a lawyer or company that provides registered agent services.

Hiring another party doesn’t have to be expensive. You can expect to spend $50 to $100 per year. One benefit of hiring a registered agent is that you get someone to help handle legal documents and important correspondence so that an official notice from the state isn’t lost in the mail.

Step 3: File the Georgia LLC Articles of Organization

The next step to forming an LLC in Georgia is to file your Articles of Organization. While there are still some things you need to do after, this filing officially establishes registers your business in the state.

Georgia provides a template you can use, but the state does recommend consulting with a professional such as an attorney to see if anything else should be added. For example, you may want to list the members of your LLC, especially if there’s more than one partner.

If you file by mail or in-person, be sure also to fill out and include the state’s transmittal form, which provides basic information such as the LLC’s mailing address, registered agent contact information, and member details. Or you can file online, which may be a more streamlined process.

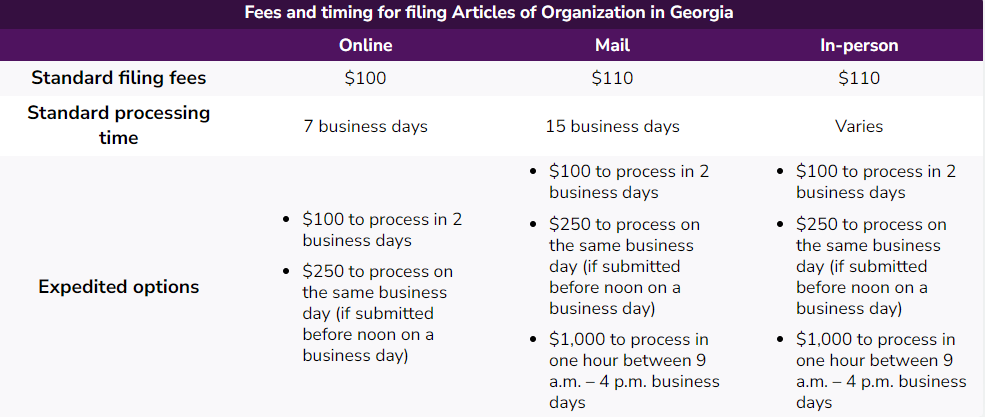

The fees and processing times for the various ways to file Articles of Organization are as follows:

Step 4: Obtain an EIN (Employer Identification Number) from the IRS

Depending on your type of operations, business owners may need to obtain an Employer Identification Number (EIN) from the Internal Revenue Service (IRS).

An EIN, a federal tax ID, is required for LLCs with employees. But even some single-member LLCs need EINs. And you may want to obtain one to make it easier to open a business bank account for your new company. You may also need an EIN to register with the Georgia Department of Revenue and Department of Labor, as discussed in Step 5.

Plus, if you don’t have an EIN, you’ll need to use your personal social security number for many business forms and tax filings. So, you may prefer to keep the business and personal information separate.

Step 5: Register with the Georgia Department of Revenue and Department of Labor

In addition to registering with Georgia SOS, you also might need to register your LLC with the state’s Department of Revenue and Department of Labor.

For state tax purposes, many businesses need to register with the Georgia Department of Revenue. For example, if you need to collect sales tax or have employees and need to withhold tax for them. Check with the Georgia Secretary of State to confirm registration requirements.

Registering with the Georgia Department of Revenue for business tax purposes can easily be done online. In as little as 15 minutes after registering, you can receive your corresponding tax number via email. Note that some types of registration, such as for businesses selling alcohol, may take longer.

For unemployment insurance tax purposes, businesses need to separately register with the Georgia Department of Labor, even if they don’t have employees. Registration can quickly be done online, and you learn if you’re liable to pay unemployment insurance taxes. If you are, then you can set up an account to pay online.

Step 6: Prepare an LLC operating agreement

After registering with the relevant departments in Georgia, you’re almost at the finish line. But, to set your LLC up for success, you should prepare an LLC operating agreement.

An LLC operating agreement is a binding contract that covers operational and financial areas like how members can be added or removed from the LLC and how profits will be distributed. In addition to helping solidify how your LLC should operate, having this agreement in place can also protect your operations from member disputes.

To create your operating agreement, you have flexibility, such as using online templates or consulting with an attorney to draft one.

Expect to spend a couple of hundred dollars for help through an online platform, up to $1,000 if you turn to a lawyer. Keep in mind that while the costs of working with a professional may be more than creating an operating agreement yourself, it’s crucial to establish a proper one to protect your LLC’s structure.

Once you complete the operating agreement, you do not need to file it with officials in Georgia. Instead, you can keep it with your records.

Step 7: Open a business bank account

The last step regarding how to start an LLC in Georgia is to open a business bank account.

Having a separate bank account for your LLC can be important for several reasons, such as:

- Establishing the separation of personal and business assets for legal liability protection

- Avoiding confusion between personal finances and business finances

- Creating a sense of legitimacy for your business

When opening a business bank account in Georgia, you can choose from several options, such as:

Option A) National banks

E.g., Bank of America, Chase Bank. National banks may have more branches near you and more convenient services such as fully online banking.

Option B) Community banks and credit unions

E.g., SunMark Community Bank, Delta Community Credit Union. Community banks and credit unions can also be appealing in their ways, such as having more local community ties. Their requirements for opening a business bank account and obtaining other services may also be more flexible than national bank policies.

Fees to open a business bank account vary among different financial institutions. But many offer free business checking, as long as you meet a few requirements, such as conducting a set number of transactions per month or holding a certain amount of cash in the account.

Even if you don’t meet these requirements or can’t find a free account that works for you, a business bank account is still likely only to cost roughly $5-10 per month.

Commonly asked questions

Below are some of the most commonly asked questions about forming an LLC in Georgia.

The cost of starting an LLC in Georgia depends on how quickly you need to complete the process and whether you do it yourself or hire a third party (e.g., an LLC formation service)

At a minimum, the price to form an LLC in Georgia is $100 if you register online. Other expenses include a minimum of $25 to reserve a business name, and you might spend around $50-$100 to hire another company as your registered agent.